B2B vs B2C SaaS: Which Business Model Will Make You More Money?

The data-driven answer that could change your entire business strategy

Choosing between B2B and B2C SaaS isn't just about who you sell to—it's about two completely different ways to build wealth. The numbers tell a story that might surprise you.

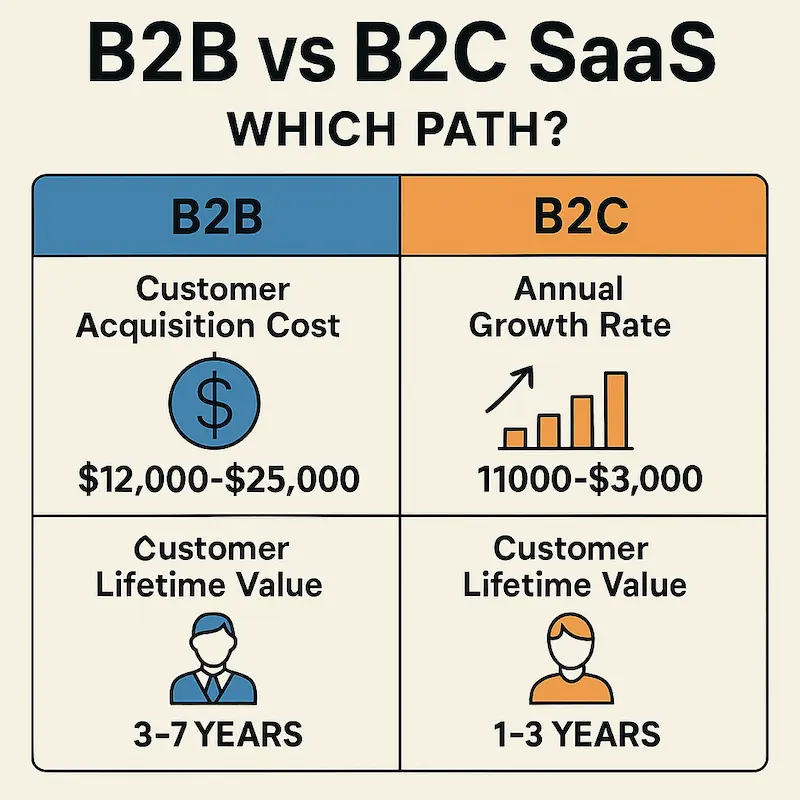

B2B SaaS costs $12,000-$25,000 to acquire each customer but grows at 11% annually. B2C SaaS costs just $1,000-$3,000 per customer but grows slower at 8% per year.

So which path should you take? Let's break down the real numbers.

The Money Game: Customer Acquisition Costs

Here's where the first major difference hits you in the wallet:

B2B SaaS Customer Acquisition:

- Average cost: $12,000-$25,000 per customer

- Sales cycle: 3-12 months (sometimes longer)

- Multiple decision makers involved

- Requires demos, case studies, and relationship building

B2C SaaS Customer Acquisition:

- Average cost: $1,000-$3,000 per customer

- Sales cycle: Minutes to days

- Individual decision maker

- Self-service sign-up process

The math is simple: B2B customers cost 8-10 times more to acquire, but there's a reason smart money keeps flowing to B2B. For detailed benchmarks on SaaS metrics across different business models, the SaaS Capital Annual Survey provides comprehensive industry data.

Market Size: The Real Opportunity

The B2B SaaS market isn't just big—it's exploding. The market was valued at $327.74 billion in 2023 and is projected to reach $1,088.15 billion by 2030. That's an 18.7% compound annual growth rate.

B2C SaaS is part of the overall SaaS market expected to hit $793.10 billion by 2029, but the growth rate sits at a steadier 8% compared to B2B's 11%.

Why B2B is growing faster: Businesses have bigger problems to solve and more money to spend solving them. When a B2B SaaS tool can save a company $100,000 annually, paying $50,000 for the software is an easy decision.

The Customer Lifetime Value Reality Check

This is where B2B SaaS really shines:

B2B SaaS customers typically:

- Stay for 3-7 years

- Pay $5,000-$100,000+ annually

- Expand usage over time (upsells)

- Refer other businesses

B2C SaaS customers typically:

- Stay for 1-3 years

- Pay $50-$500 annually

- Limited expansion potential

- Higher churn rates

Do the math: A B2B customer paying $20,000 annually for 5 years generates $100,000 in lifetime value. A B2C customer paying $200 annually for 2 years generates $400.

The Integration Factor (B2B's Secret Weapon)

Here's something most people miss: 39% of B2B buyers say integration with existing software is their most important factor when choosing a SaaS provider.

Once a B2B SaaS tool is integrated into a company's workflow, switching becomes painful and expensive. This creates what Warren Buffett calls an "economic moat"—a competitive advantage that's hard to replicate.

B2C customers, on the other hand, can switch apps with a few taps. The switching cost is near zero.

The Brutal Truth About Competition

B2B SaaS: Lower search volumes but less competition. A keyword getting 500 searches per month in B2B can be incredibly valuable because those searchers have real budgets.

B2C SaaS: Higher search volumes but fierce competition. You're competing with apps that have millions in marketing budgets and venture capital backing.

The B2C market changes faster because consumers have lower switching barriers. What's trending today might be forgotten tomorrow.

Which Should You Choose?

Choose B2B SaaS if:

- You can handle longer sales cycles

- You want higher profit margins

- You prefer fewer, higher-value customers

- You can build relationships and provide consultative selling

- You have expertise in a specific business problem

Choose B2C SaaS if:

- You need faster revenue validation

- You can handle high-volume, low-margin business

- You have a product that appeals to millions

- You're great at viral marketing and social media

- You can iterate quickly based on user feedback

The Hybrid Approach: Why Not Both?

Smart companies don't always choose sides. Slack started as a B2B tool but has B2C elements. Zoom serves both markets with different pricing tiers. Understanding how successful companies navigate this dual approach is crucial—Harvard Business Review's analysis of B2B2C strategies offers valuable insights into these hybrid models.

You can start with one market and expand to the other once you have product-market fit and steady revenue.

The Bottom Line

B2B SaaS is like real estate investment—higher upfront costs, longer time to profit, but much higher returns over time. B2C SaaS is like day trading—faster results, lower barriers to entry, but you need massive volume to make serious money.

The data is clear: B2B SaaS has higher customer lifetime value, better retention, and stronger growth rates. But B2C SaaS offers faster validation and lower acquisition costs.

Your choice should depend on your resources, timeline, and risk tolerance. But remember—the most successful SaaS companies solve real problems for people willing to pay to solve them.

Whether you choose B2B or B2C, focus on creating value first. The money will follow.

The SaaS market is projected to hit nearly $800 billion by 2029. There's room for both approaches—but only if you pick the right one for your situation and execute relentlessly. For comprehensive market analysis and growth projections across different SaaS segments, Gartner's latest SaaS market research provides authoritative industry forecasts.

Choose wisely, build something people actually want, and remember: every successful SaaS company started with someone deciding to solve a problem. Make sure you're solving the right problem for the right people.